Advantages and Disadvantages of Return on Equity

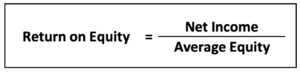

Return on Equity is the measurement of company ability to generate profit from the available equity. It is the percentage that arrives from the company’s net profit over the stock equity. It is the management’s ability to turn equity into profit.

Good or bad returns on equity will depend on the type of industry. For example, the service industry will not require huge investment, so the stock equity in balance is also not high. It will lead to a high return on equity. On the other hand, the Mining industry requires a huge investment which means large equity. So it is highly likely to have a small return on equity.

Beside the resource requirements, it also relates to the company financial structure. If the company is financed by long-term debt rather than equity, it will have a high ratio. If they are financed by equity, they will likely have a low ratio.

Return on Equity Formula

Advantages of Return on Equity

- Attract more investors: Return on equity is the tool that measures company profit compare to average equity. It is one of the investor concerns, as they want to know how much the company can generate base on their investment. If the company has a good ratio, it will attract more investors.

- KPI for management: Shareholders can use this ratio to evaluate management performance which prevents the conflict of interest between both parties.

Disadvantages of Return on Equity

- Not tell exact performance: The ratio depend on the amount of equity on the balance sheet which can be various due to capital structure and industry type.

- Ignore time value of money: the ratio depends on the net income which completely ignores the time value of money.

- Subject to manipulation: Net income depends on the accounting policy, estimation, and many other factors influenced by the management. Moreover, management can manage to improve ratios by decrease equity using share buyback.