Bond Premium Journal Entry

Overview

The company may issue the bond at a premium when the contractual interest rate of the bond is higher than the market rate of interest. Likewise, the company needs to make the journal entry to account for the premium with the credit of the unamortized bond premium account.

The company issues the bond at a premium when the selling price of the bond is higher than its face value. It is not strange that the company can sell the bond at a premium if its bond gives a higher rate of return than the market rate of interest. For example, the contractual interest rate on the bonds is 10% but the market interest rate is only 8%.

Bond premium journal entry

When the company issues the bond at a premium, it can make the bond premium journal entry by debiting the cash account and crediting the unamortized bond premium account and the bonds payable account.

| Account | Debit | Credit |

|---|---|---|

| Cash | $$$ | |

| Unamortized bond premium | $$$ | |

| Bonds payable | $$$ |

The balance of the unamortized bond premium will be presented as an addition to the bond payable on the balance sheet.

Under the matching principle of accounting, the bond premium should be amortized over the life of the bond; hence, the term “unamortized bond premium” is used here. Likewise, with the amortization, the balance of the unamortized bond premium will be reduced at each accounting period until it becomes zero at the end of bond maturity.

Bond premium example

For example, on March 1, the company ABC issues a $200,000 bond with a five-year period at a premium which it sells for $205,000. The bond gives 10% interest which is payable annually.

In this case, the company ABC can make the bond premium journal entry on March 1, when it issues the bond at a premium as below:

| Account | Debit | Credit |

|---|---|---|

| Cash | 205,000 | |

| Unamortized bond premium | 5,000 | |

| Bonds payable | 200,000 |

It is useful to note that the unamortized bond premium account may also be called “bond premium” or “premium on bonds payable”. Hence, the term of this account may be different from one company to another. However, the term “unamortized bond premium” here can also be used as a reminder for the company to amortize the bond premium in order to comply with the matching principle of accounting.

Amortization of bond premium

As mentioned, the unamortized bond premium that the company records when issuing the bond premium will need to be amortized over the life of the bond. This is done in order to have a carrying value of bonds payable on the balance sheet equal the face value of the bond at the end of the bond maturity.

This is due to the carrying value of bonds payable equal the balance of bonds payable plus the balance of unamortized bond premium that is recorded on the balance sheet at the time of issuing bonds.

| Carrying value of bonds payable on the balance sheet | |

| Bonds payable | $$$ |

| Add: unamortized bond premium | $$$ |

| Carrying value of bonds payable | $$$ |

Hence, the unamortized bond premium needs to be reduced to zero at the end of the bond maturity through amortization.

Likewise, the company can make the journal entry for the amortization of bond premium by debiting the unamortized bond premium account and crediting the interest expense account.

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | $$$ | |

| Interest expense | $$$ |

The amortization of the bond premium can be done with the straight-line method if the amount is small or immaterial. On the other hand, if the amount is material, the company needs to amortize the bond premium using the effective interest rate method.

Example for amortization of bond premium

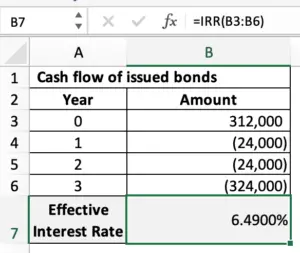

For example, the company ABC issue $300,000, three-year, 8% bonds for $312,000 which is 104% of their face value. The interest is payable at the end of each year for the three years periods of the bonds.

The effective interest rate is calculated to be 6.49% based on the cash flows (from the issuing date to the end of the maturity) of the $300,000 bonds issued.

What is the journal entry for the amortization of bond premium for the three years using:

- Straight-line method

- Effective interest rate method

Solution:

With the issuance of $300,000 bonds at a premium price of $312,000, the company ABC can make the journal entry as below:

| Account | Debit | Credit |

|---|---|---|

| Cash | 312,000 | |

| Unamortized bond premium | 12,000 | |

| Bonds payable | 300,000 |

Amortization using the straight-line method

Using the straight-line method, the $12,000 of bond premium can be amortized to be $4,000 per year over the three-year period of the bond.

In this case, the company ABC can make the journal entry for amortization of bond premium using the straight-line method for the three years as below:

Year 1:

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | 4,000 | |

| Interest expense | 4,000 |

Year 2:

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | 4,000 | |

| Interest expense | 4,000 |

Year 3:

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | 4,000 | |

| Interest expense | 4,000 |

Likewise, at the end of the third year, the balance of the unamortized bond premium will become zero ($12,000 – $4,000 – $4,000 – $4,000). Hence, the carrying value of bonds payable at the end of the maturity will equal their face value of $300,000.

Amortization using the effective interest rate method

With the effective interest rate of 6.49%, the amortization of bond premium can be calculated as in the table below:

| Year | Bonds Payable | Premium | Carrying Value | Interest payment | Interest expense | Amortization |

|---|---|---|---|---|---|---|

| 0 | 300,000 | 12,000 | 312,000 | – | – | – |

| 1 | 300,000 | 8,249 | 308,249 | 24,000 | 20,249 | 3,751 |

| 2 | 300,000 | 4,254 | 304,254 | 24,000 | 20,005 | 3,995 |

| 3 | 300,000 | 0 | 300,000 | 24,000 | 19,746 | 4,254 |

| Total | 72,000 | 60,000 | 12,000 |

*Interest payment – first year = $300,000 x 8% = $24,000

**Interest expense – first year = $312,000 x 6.49% = $20,249

***Amortization – first year = $24,000 – $20,249 = $3,715

Likewise, the company ABC can make the journal entry for bond premium amortization using the effective interest rate method for the three years as below:

Year 1:

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | 3,751 | |

| Interest expense | 3,751 |

Year 2:

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | 3,995 | |

| Interest expense | 3,995 |

Year 3:

| Account | Debit | Credit |

|---|---|---|

| Unamortized bond premium | 4,254 | |

| Interest expense | 4,254 |

Hence, we can see the difference between the amortization of bond premium using the straight-line method and the amortization using the effective interest rate method as below:

| Year | Straight-line | Effective interest rate | Difference |

| 1 | 4,000 | 3,751 | 249 |

| 2 | 4,000 | 3,995 | 5 |

| 3 | 4,000 | 4,254 | (254) |

| Total | 12,000 | 12,000 | 0 |

Note:

The effective interest rate of 6.49% can be calculated using the IRR() formula from the excel spreadsheet below: