Fixed Asset Reconciliation

Fixed Asset Reconciliation is the process of putting together fixed asset balance on the balance sheet and the fixed asset register in order to check if they are correct and agree. It aims to confirm that the fixed asset balance is completed, accurate and consistent.

Fixed Asset is the long term property that the company owns and use to generate profit. Fixed asset is the account which presents in the balance sheet. In this account, it consists of few fixed asset classes and many detailed items. Some companies even have thousand of fixed asset items from the personal computer to the big building. So in order to control these assets, accountants record them in one listing call fixed asset register or fixed asset listing.

Fixed Asset Register

Fixed Asset Register or fixed asset listing is the spreadsheet or similar software that consists of the detailed information of each fixed asset. The fixed asset register should consist of description, name, detail specification, tag number, purchase date, cost, and so on.

| No | Description | Classification | Cost | Purc date | Tag | Accumulated Depreciation | NBV | Note |

| 1 | MacBookPro | Computer | ||||||

| 2 | Tesla | Vehicle |

Fixed Asset Reconciliation

Reconciliation is the process of matching two sources of data to ensure that it is accurate and complete.

- Extract Balance Sheet: we simply extract the balance sheet at the end of accounting period. It should include the fixed asset by class with both cost and accumulated depreciation and the total balance. It may be different from one accounting software to another, however the concept is the same. We want to have cost & Accumulated depreciation by fixed asset class.

- Extract Fixed Asset register: Next we will extract the fixed asset register on the same balance sheet date. We need to ensure that the depreciation for the last period already applies to the listing. Moreover, we should check the formula or recalculate it to ensure accuracy before reconciliation.

- Compare Cost: The first thing to check is the total cost of fixed asset, both cost on the FA register and balance sheet should be the same. After that, we need to check the total cost of FA in each class, sometimes the total cost is correct but each class is over and understate.

- Compare Accumulated Depreciation: Similar to cost, we must check both total and accumulated balance by fixed asset class. If there is any variance, we must investigate.

- Compare Net Book Value: the final step is the net book value. If both cost and accumulated depreciation are matching, the NBV should be correct.

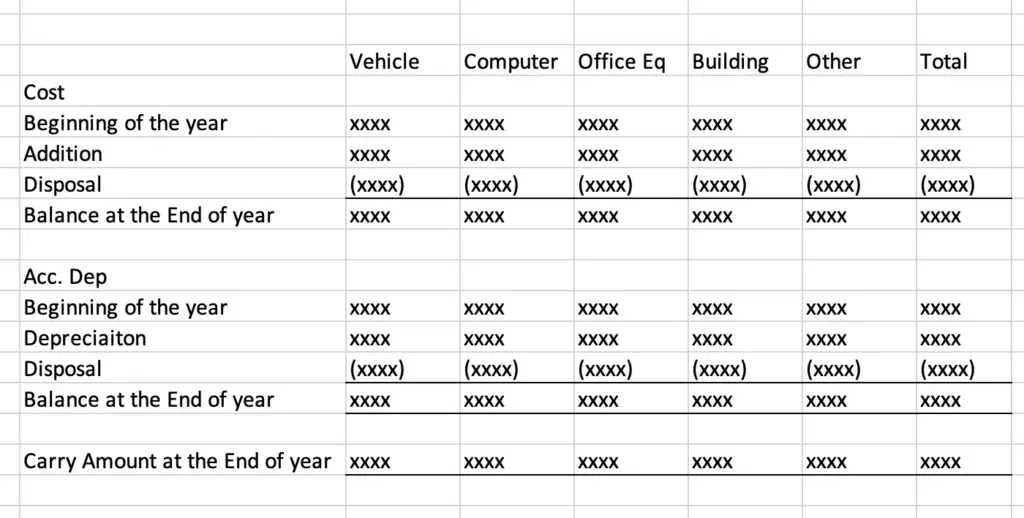

Fixed Asset Movement

As the name suggested, it is the movement of fixed assets by class from the beginning to the end of the year. It helps management or other users to see the fixed asset movement during the year.

Reasons of Different between Fixed Asset Balance and Fixed Register

| Reasons | Explanation |

|---|---|

| Error in Formula | The most common cause of the difference is the error in the register’s excel formula. Most of the company use excel to control the fixed asset register, so if there is any error in formula such as depreciation calculation, it will show difference with the balance sheet. Balance sheet is extracted from accounting system, so it rarely has any issue with the formula. |

| Fixed Asset Disposal | The fixed asset disposal may not yet remove from the fixed asset register. |

| Fixed Asset Addition | New purchase fixed assets during the year may not yet update into the fixed asset register. |

| Wrong Classification | There may be a wrong classification between accounting system and the fixed register. So there will be differences in each fixed asset class. |