Single Step Income Statement

Single Step Income Statement is the simple version of an income statement that shows only two categories, income, and expense. The expenses category include the cost of goods sold are listed in one column. It means that there is no separation between the cost of goods sold, operating expense, and non-operating expense. All of these categories are mixed together and totaled.

The income statement includes revenue, other income, COGS, Operating Expense, and non-operating expenses. There are a few subtotals that contain the gross profit, operating margin, EBIT, and Net Income. For a single-step income statement, all-expense are combined, there is only one subtotal which is the net income.

Key Elements of Single-Step Income Statement

Revenues

It is the total amount of income which the company generated by selling the goods or service. It related to the main business activities of the company.

Other non-operating income also part of this revenue section. Besides the main revenue source, company may generate other incomes that are not the main business activities. These incomes include the sale of fixed assets, Interest income from a cash deposit, revaluation gain, gain on exchange rate, and so on.

Both revenue types will be included in one section in the single-step income statement.

Expenses

Under expenses section, both operating and non-operating expenses will be combined together. Operating expenses are the expense mainly to supporting primary business activities. Without these expenses, the company will not be able to operate. They include payroll, rental expenses, marketing expenses, admin expenses, and so on.

Non-operating expenses are the expenses that are not related to business activities such as interest expense, lawsuit, and loss on disposal of a fixed assets.

In addition to these two types of expenses, cost of goods sold also part of this expenses section.

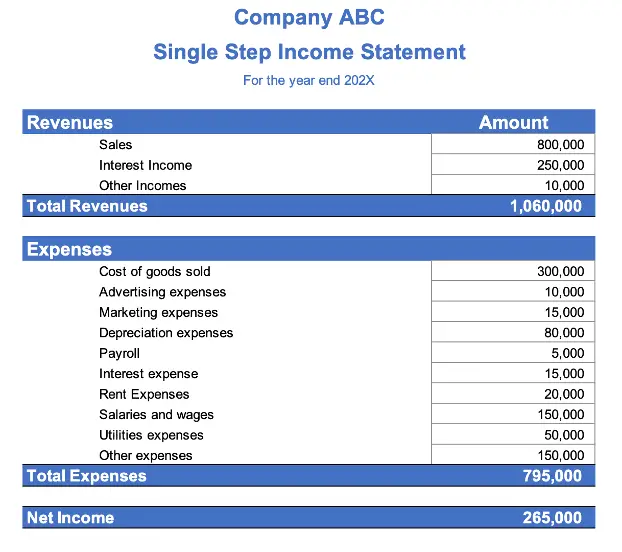

Single Step Income Statement Example

Difference Between Single Step And Multiple Step Statements

When it comes to income statements, there are two main methods of presentation: single-step and multiple-step. Both have their own advantages and disadvantages, so it’s important to understand the differences between them in order to make an informed decision about which one is best for your business.

The single-step income statement is the simplest format of all. It focuses solely on revenue and expenses, providing a straightforward overview of a company’s financial results over a period of time. By contrast, the multiple-step income statement provides more detailed information by breaking down certain categories further into subtotals that can provide additional insights into how well a company is performing.

This difference between the two types of statements affects how they are used. A single-step statement is best suited for internal review by management since it simplifies the financials to make them easier to read and understand quickly, while a multiple-step statement is better for external reporting since it provides more detailed information that can be easily understood by investors or other stakeholders.

By understanding the different features of these two statements, businesses can determine which type best meets their needs. With this knowledge, they can make informed decisions about which type of income statement works best for them.

Ultimately, the choice of which method to use will depend on the needs of your business and what kind of information you need to glean from your income statement. Whether you choose single- or multiple-step, you’ll be able to gain valuable insights into your financial performance that will help inform your decisions going forward.

Benefits of Single-Step Income Statement

Easy to prepare: Single-step income statement is very easy to prepare if compare to a multi-step income statement. It doesn’t require a high-level skill to analyze and separate expenses into categories. All expenses are put together which is easier for the accountant.

Easy to Understand: some financial users do not care much about the detail, they just want to know the bottom line which is the net income. They may confuse with many subtotals of multi-step income statements. With a single step, they will be able to get the net income easily. Some users do not understand the difference between COGS & Operating expenses. By putting them together, it will be easy for them.

Best fit with small business: Small companies may not have complicated transactions and charts of accounts. The single-step income statement is simple enough for management.

Disadvantages of Single-Step

A single step income statement is not suitable for all business entities. One of the primary drawbacks is that it does not show detailed information about the expenses of a business. This can be problematic because businesses need to know where their money is being spent in order to make informed decisions about budgeting and future investments.

Additionally, since there are no separate categories for different expenses, it becomes difficult to compare data from previous years and track performance trends over time.

Finally, a single-step income statement does not provide an accurate picture of a business’s profitability as it fails to properly allocate the costs of goods sold. This lack of detail can make it difficult to assess the true financial health of the company and make sound decisions regarding operations and investments.

Advantages of A Multiple-Step

Multiple step income statement offers more comprehensive and informative information than the single-step statement. This type of income statement is considered to be more detailed and provides a broader analysis of an organization’s financial performance.

The multiple-step statement lists each major category of income or expense separately, with subtotals for each type of income and expense. This allows for a closer examination of expenses and incomes, thus providing investors with a better understanding of the company’s financial health. Additionally, it also allows for a deeper look into the different activities from which the company generates its revenues.

Furthermore, this statement also reveals non-operating items such as gains or losses from investments or extraordinary items like natural disasters that can significantly impact an organization’s financial performance. By breaking down operating and non-operating expenses and incomes, investors are able to get a clearer picture of the company’s overall profitability.

Lastly, this type of income statement is beneficial to management because it gives them insights into ways they can improve operational efficiency by comparing operational costs over time. This helps decision-makers identify areas where they can cut costs while still meeting their goals. Transitioning now to the drawbacks associated with a multiple-step statement.

Disadvantages of A Multiple-Step

One disadvantage is the difficulty in understanding, especially for those without a background in accounting. Since there are more line items and categories than on a single-step income statement, it can be harder to interpret the results. This can lead to inaccurate financial statements and incorrect analyses.

Another disadvantage of the multiple-step income statement is that it takes more time to prepare. This is because more calculations and reconciliations need to be done for every line item and category listed in the statement. It also requires more manual labor, which can be costly if an accountant or bookkeeper is used to generate the statement.

The multiple-step income statement may also increase the risk of errors due to its complexity. For instance, incorrect entries may not be easily identified if there are too many lines or categories listed on the statement.

Moreover, if one line item is calculated incorrectly, this could throw off all other related line items as well as the final calculation of net earnings or a net loss. With these risks in mind, it’s important that organizations have proper processes and controls in place when preparing their financial statements. This ensures the accuracy and reliability of their financial information.

Given these potential issues with a multiple-step income statement, it’s essential for those preparing such statements to have strong knowledge of accounting principles and practices as well as experience with financial reporting systems and tools. Resources such as online courses or tutorials can provide further education on single vs multiple step statements so users can make informed decisions about which type of statement works best for them.

Consider Before Choosing One Over Another

When deciding which type of income statement to use, single or multiple steps, there are several factors to consider. The three main considerations are the complexity, time spent, and detail of the report.

| Factor | Single Step | Multiple Step |

|---|---|---|

| Complexity | Low | High |

| Time | Fast | Slow |

| Detail | Low | High |

In order to decide which type of income statement would be most appropriate for your business needs, you must take into account both the complexity of your company’s finances and how much time you can spend on creating the statement. If you need a detailed report but don’t have much time available then a single-step statement may be a better option. If you have plenty of time but need an in-depth report then a multiple-step statement might be more suitable for you.

Conclusion

It is essential to understand the difference between single-step and multiple-step income statements. Depending on the size and complexity of your business, one approach may be more beneficial than the other. Single-step statements are simpler to create and provide a quick overview of your financial performance. However, if you need more detailed information about your finances, multiple-step statements can give you this additional level of detail. Ultimately, it’s up to you to decide which approach is best for your business.

When making this decision, consider what type of information you need from an income statement as well as how much time and effort it will take to create one or the other. While a single-step statement may be quicker and easier to make, if it doesn’t provide all the information you need then there’s no point in using it. Similarly, while a multiple-step statement can provide more detail, it may only be worth the extra time and effort if that detail is necessary for your purposes.

It’s also important to remember that there are resources available if you want more education on how each type of income statement works. By taking advantage of these resources, you can ensure that whichever approach you choose is right for you and your business.