Advantages and Disadvantages of Return on Investment

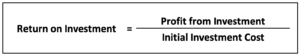

Return on Investment is the financial ratio that measures how well the investment is. It is the percentage of the profit over the initial cost. A good investment will generate a high return on investment and will be able to recover in a shorter time.

Company will rank the investment project by its rate of return. They are looking for a higher return project which allows them to maximize their profit. Moreover, they want to get the initial investment back as soon as possible to minimize the risk which can happen at any time.

Return on Investment Formula

Advantages of Return on Investment

- To range multiple projects: It helps the company range multiple projects from most profitable to lowest profit. The management can allocate funds base on the investment hierarchy.

- To maximize profit with the available resources: With limited resources, we want to ensure that the profit is maximum.

- Easy and Simple: the calculation is very simple and straightforward. It makes the scene for most of the people even they do not have any accounting background.

- Allow to compare different projects: We can use the return on investment to compare not only the external project but also the internal project in order to maximize the overall profit of the company.

Disadvantages of Return on Investment

- Ignore time value of money: return on investment does not include the time value of money. The project may not provide any profit if we consider the time value of money. The investment that generates profit over the long term will have more advantages while it does not provide less profit to the investors.

- Different calculation: Different companies may use different components to calculate the return on investment. Some may use the gross margin and other use the investment gain instead of profit.