Disclaimer Audit Opinion

Disclaimer audit opinion is the opinion used to express that auditor is not able to obtain appropriate audit evidence to draw a final conclusion about the company’s financial statement. Auditors mean that there are no opinions on a reliable financial statement. The auditor had difficulty obtaining the necessary documents to complete their work.

Auditors are responsible for providing accurate and reliable opinions on the financial statements. When they cannot obtain sufficient or appropriate information, then it is reasonable that an alternate conclusion is drawn by them in order not just assume facts without basis.

In this case, the auditors cannot provide a true and fair view opinion over the report as there is no supporting document to prove them. At the same time, they also cannot qualify the report as well due to the same reasons. So it likes a neutral opinion which the auditors do not say the report is right or wrong.

The problem could cause by a lack of appropriate documentation for accounting transactions. The lack of control over supporting documents is a huge problem, leading to loss or theft.

Furthermore, auditors may also present this opinion even though audit evidence exists. The audit evidence may not be sufficient to constitute an appropriate review.

The management may decide to hide some supporting documents to cover some of the fraud that they have committed in the company. They make it difficult for auditors to gather audit evidence. It will become a problem for them to work independently.

Example

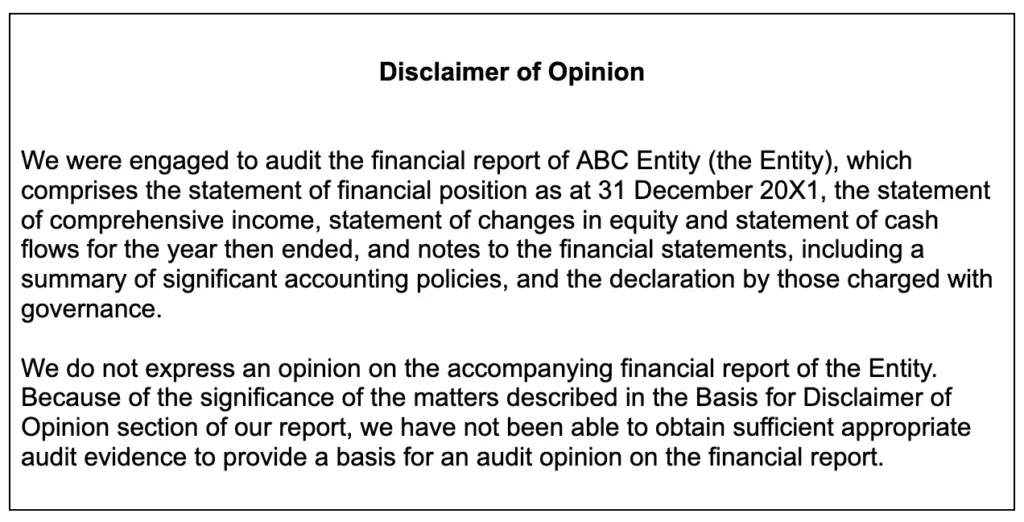

This is an example of a disclaimer audit opinion.

When auditors fail to collect appropriate audit evidence, they should explain the areas leading up to their opinion. They also need to explain why they cannot collect the audit evidence.

Reasons for Disclaimer Opinion

The main reason that auditors issue disclaimer opinions are due to the lack of sufficient audit evidence. Most of these reasons can be broken down into two categories.

This is a very real concern for auditor who reviews financial statements because it’s possible that they won’t have any evidence to work with. The clients cannot provide the supporting documents to auditors to review.

Audit evidence is often not sufficient and appropriate for different reasons. This can be because the expected quality or quantity does not exist. The clients are able to deliver the audit document to the auditors, but those documents are not sufficient. The auditors cannot make conclusion on the financial statement.