Income Summary Journal Entry

Overview

In the manual accounting system, the company uses the income summary account to close the income statement at the end of the period. Likewise, the income summary journal entry is necessary as the company needs to transfer all the revenues and expenses accounts to the income summary account before it can close the net income into the retained earnings account.

The income summary is a temporary account that its balance is zero throughout the accounting period. The company only uses this account at the end of the period to clear all accounts in the income statement. Likewise, after transferring the balances of all accounts in the income statement to the balance sheet, the income summary balance will become zero again.

Income summary journal entry

Income summary for revenues

The company can make the income summary journal entry for the revenue by debiting the revenue account and crediting the income summary account.

| Account | Debit | Credit |

|---|---|---|

| Revenue | $$$ | |

| Income summary | $$$ |

Income summary for expenses

The company can make the income summary journal entry for the expenses by debiting the income summary account and crediting the expense account.

| Account | Debit | Credit |

|---|---|---|

| Income summary | $$$ | |

| Expense | $$$ |

Closing income summary to retained earnings

After transferring the balance from all revenue and expenses to the income summary account, the company can make the journal entry to transfer the net balance in this account to the retained earnings to finally close the income statement at the end of the period.

This net balance of income summary represents the net income if it is on the credit side. On the other hand, if it is on the debit, it presents the net loss of the company.

Net income

The company can make the income summary journal entry by debiting the income summary account and crediting the retained earnings if the company makes a net income.

| Account | Debit | Credit |

|---|---|---|

| Income summary | $$$ | |

| Retained earnings | $$$ |

Net loss

On the other hand, if the company makes a net loss, it can make the income summary journal entry by debiting retained earnings account and crediting the income summary account instead.

| Account | Debit | Credit |

|---|---|---|

| Retained earnings | $$$ | |

| Income summary | $$$ |

Income summary example

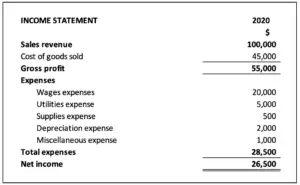

For example, the company ABC has the income statement as of 2020 as below:

In this case, the company ABC can make the income summary journal entry for revenue and expense as below:

Revenue

| Account | Debit | Credit |

|---|---|---|

| Sales revenue | 100,000 | |

| Income summary | 100,000 |

Expenses

| Account | Debit | Credit |

|---|---|---|

| Income summary | 73,500 | |

| Cost of goods sold | 45,000 | |

| Wages expenses | 20,000 | |

| Utilities expense | 5,000 | |

| Supplies expense | 500 | |

| Depreciation expense | 2,000 | |

| Miscellaneous expense | 1,000 |

Then it can make the journal entry to transfer the net credit balance in the income summary of $26,500 (100,000 – 73,500) to the retained earnings account as below:

| Account | Debit | Credit |

|---|---|---|

| Income summary | 26,500 | |

| Retained earnings | 26,500 |

Income summary debit or credit

It may be assumed that the income summary normal balance is on the credit side as this refers that the company expects the net income at the end of the period, in which it usually does expect that. However, if we base our opinion on this, it is arguable that the new company that usually expects the loss at the beginning years would assume that the income summary normal balance is on the debit side instead.

Additionally, it is important to note that the income summary account plays both roles of the debit and the credit at the same time when the company closes the income statement at the end of the period. For example, the expenses are transferred to the debit side of the income summary while the revenues are transferred to the credit side of the income summary.

And another point to consider is that throughout the accounting period, the balance of income summary is zero as the company only uses this account at the end of the period, and then its balance becomes zero again when the new accounting period starts.

Based on these viewpoints, we may conclude that the income summary has no normal balance (i.e. its normal balance can either be debit or credit).