Negative Accounts Payable

Negative Accounts payable happen when the company accidentally paid more than the recorded payable balance.

Accounts payable is the liability account presents on the balance sheet. Due to the nature of accounts, the liability will increase on the credit side and decrease on the debit side. But it is not mean that the accounts payable presented a negative balance. Balance is still presented as a positive figure in the report.

When purchasing on credit, the company will record the accounts payable. The double entry is debiting assets/expenses and crediting the accounts payable. By this time, the accounts payable will be on the balance sheet. It increases on the credit side, but it still presents as a positive figure.

When the company settles the accounts payable, they simply debit the accounts payable and credit cash paid. This transaction will reverse the accounts payable to zero balance. The company usually paid the amount equal to the accounts payable.

If there are some errors in the company make payment more than the accounts payable. The accountants record the debit accounts payable more than the available balance, so it will generate a negative balance.

How Accounts Payable Show on Balance Sheet?

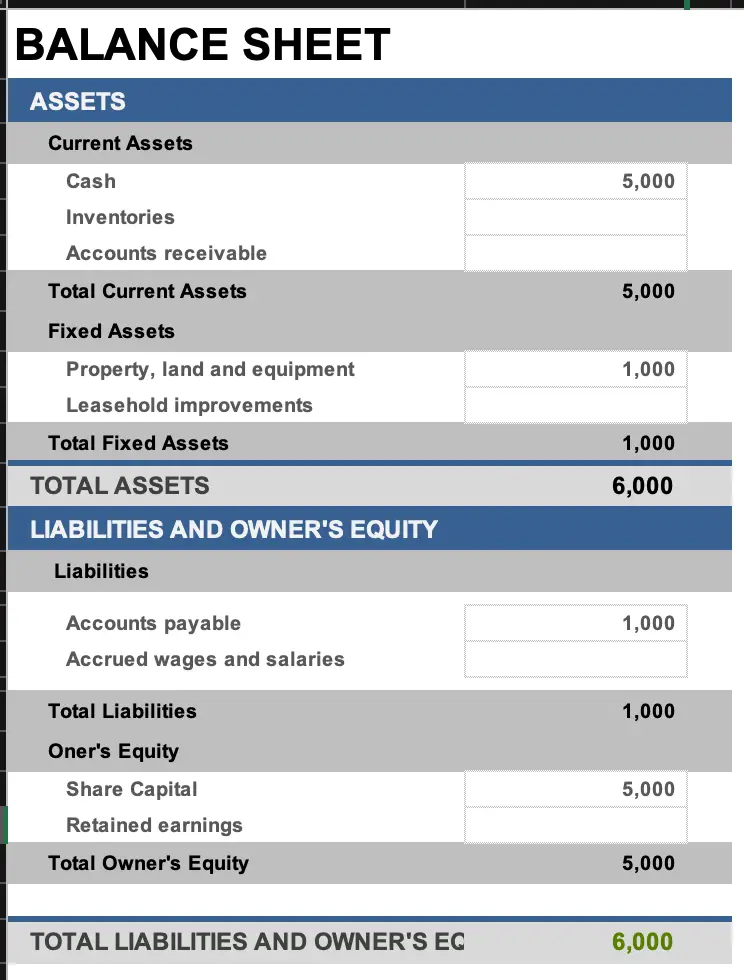

The company has only Cash at the bank $ 5,000 and share equity $ 5,000. During the month, the company purchases the furniture $ 1,000 on credit.

The journal entry is debiting furniture $ 1,000 and credit accounts payable $ 1,000.

| Account | Debit | Credit |

|---|---|---|

| Fixed Assets – Furniture | 1,000 | |

| Accounts Payable | 1,000 |

The accounts payable will present on the balance sheet as follow:

One week later, the company settle the accounts payable $ 1,000 with cash.

The cash will be reduced by $ 1,000 and the accounts payable will be reversed as well.

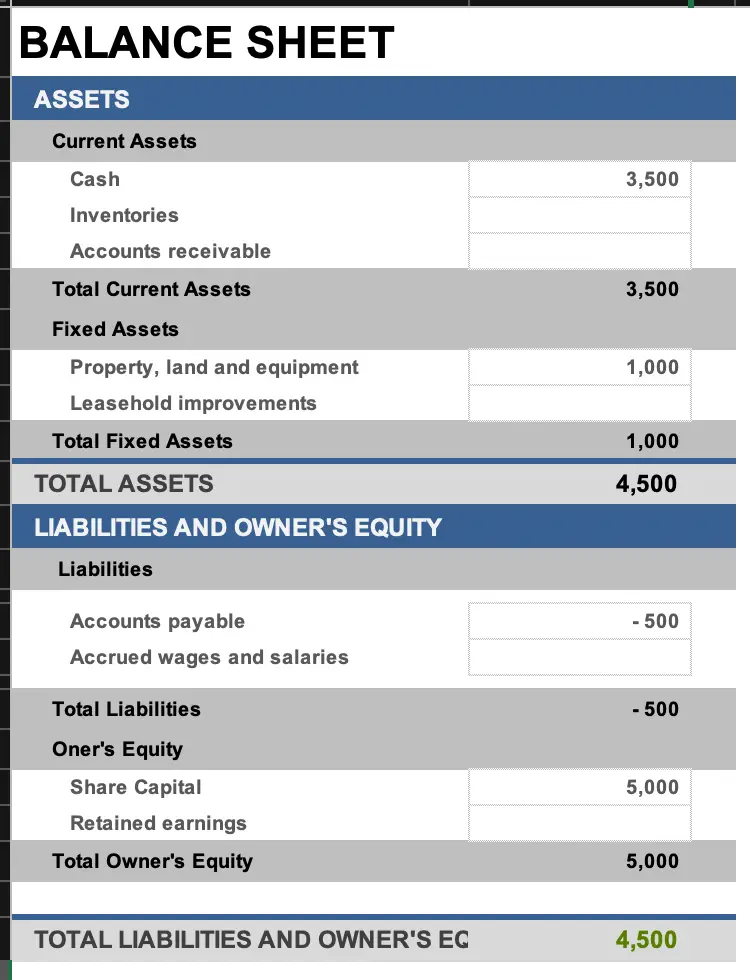

On the other hand, if the company pays more than $ 1,000 due to some error, it will generate negative accounts payable. Let’s say the company paid $ 1,500 instead due to the mistake.

The journal entry is debiting accounts payable $ 1,500 and credit cash of $ 1,500.

| Account | Debit | Credit |

|---|---|---|

| Accounts Payable | 1,500 | |

| Cash | 1,500 |

The accounts payable will be present negative accounts payable as follows:

How to Fix Negative Accounts Payable?

The negative accounts payable is the wrong balance which needs to fix and correct.

First, accountants have to extract the accounts payable aging which total by suppliers’ names or invoice numbers. It may be different depending on the accounting software.

After that, we have to look for the negative balance which attaches to any specific supplier or invoice number. Only a few transactions lead to negative accounts payable and it requires adjustment.

Next, we have to check the detailed transaction which leads to a higher payment than the recorded payable. It may be related to any adjustment as well. The payment of accounts payable is greater than the recorded balance, so the accounting software will deduct it to the negative balance.

One of the possible reasons is the accountants recorded payment but they do not record the accounts payable. So it can be solved by recording the accounts payable in the first place.

The other possible error can be the result of a wrong recording, the accountant needs to double-check the supporting documents and correct them accordingly.