Rent paid in advance

Overview

In accounting, the rent paid in advance is an asset, not an expense, as the amount paid represents the advance payment for the future use of the rental property such as office space, etc. Likewise, the company needs to record the rent paid in advance as the prepaid rent (asset) in the journal entry.

The prepaid rent will expire throughout the passage of time when the company starts using the rental property. Hence, the company needs to record rent expense for the period as the expiration cost of the prepaid rent occurs.

Journal entry for rent paid in advance

The company can make the journal entry for the rent paid in advance by debiting the prepaid rent account and crediting the cash account.

| Account | Debit | Credit |

|---|---|---|

| Prepaid rent | $$$ | |

| Cash | $$$ |

Prepaid rent is an asset account, in which its normal balance is on the debit side. Likewise, in this journal entry, the net impact on the balance sheet is zero as one asset (prepaid rent) increases while another asset (cash) decreases.

Later, when the rent expense incurs, the company can make the journal entry to transfer the balance from prepaid rent to rent expense for the period as below:

| Account | Debit | Credit |

|---|---|---|

| Rent expense | $$$ | |

| Prepaid rent | $$$ |

Likewise, after this journal entry, the balance of the rent paid in advance that the company has recorded in the prior period will be will reduced by the rental fee for the period.

Rent paid in advance example

For example, on December 29, 2020, the company ABC pays the $30,000 rent in advance for 6 months for the office rent from January 2021 to June 2021.

In this case, the company ABC can make the journal entry for the rent paid in advance on December 29, 2020, as below:

| Account | Debit | Credit |

|---|---|---|

| Prepaid rent | 30,000 | |

| Cash | 30,000 |

Then, on January 31, 2021, the company ABC can make the adjusting entry to record the rent expense by transferring the one-month balance of prepaid rent to rent expense with the below journal entry.

| Account | Debit | Credit |

|---|---|---|

| Rent expense | 5,000 | |

| Prepaid rent | 5,000 |

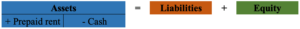

Rent paid in advance accounting equation

In the accounting equation, we can see that the transaction of the rent paid in advance increases one asset while decreasing another asset at the same time. Likewise, the transaction of rent paid in advance only occurs on the assets of the accounting equation.

If we use the number in the above example, we get the accounting equation for the rent paid in advance on December 29, 2020, as below: