Rent received in advance

Overview

Sometimes, the company may have and rent its available property for extra revenue, such as available office space, etc. In this case, it needs to properly make a journal entry for the rent received as revenue when it is earned and if the company receives cash for rent in advance, it needs to recognize it as a liability (unearned rent).

Under the accrual basis of accounting, the company should only record the revenue when it is earned. Likewise, the rent received in advance is recorded as a liability due to the lessee or tenant has not used the property yet when the company receives the cash for rent.

Journal entry for rent received in advance

The company can make the journal entry for rent received in advance by debiting the cash account and crediting the unearned rent.

| Account | Debit | Credit |

|---|---|---|

| Cash | $$$ | |

| Unearned rent | $$$ |

Unearned rent is a liability account, in which its normal balance is on the credit side. In this journal entry, both assets and liabilities on the balance sheet increase by the same amount.

When the lessee has used the rental property, the company can make the journal entry to record the rent revenue that it has earned for the period by transferring the unearned rent to the revenue as below:

| Account | Debit | Credit |

|---|---|---|

| Unearned rent | $$$ | |

| Rent revenue | $$$ |

In this journal entry, the balance in the unearned rent account is transferred to the rent revenue account in the amount of the rental fee for the period.

Rent received in advance example

For example, on December 28, 2020, the company ABC has received the rental fee in advance for the available office space that it has leased out to another company. The amount of the rental fee is $15,000 which is for 3 months of rent starting from January 01, 2021, to March 31, 2021.

In this case, the company ABC can make the journal entry for the rent received in advance on December 28, 2020, as below:

| Account | Debit | Credit |

|---|---|---|

| Cash | 15,000 | |

| Unearned rent | 15,000 |

In this journal entry, both total assets and liabilities on the balance sheet increase by $15,000.

And then, on January 31, 2021, it can make the adjusting entry to record the rent revenue with the one-month revenue it has earned in January as below:

| Account | Debit | Credit |

|---|---|---|

| Unearned rent | 5,000 | |

| Rent revenue | 5,000 |

In this journal entry, total liabilities on the balance sheet decrease by $5,000 while total revenues on the income statement increase by $5,000. Likewise, the remaining balance of unearned rent is $10,000 (15,000 – 5,000) as of January 31, 2021.

Accounting equation for rent received in advance

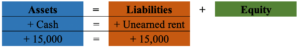

Rent received in advance makes one asset (cash) and one liability (unearned rent) on the balance sheet increase in the same amount. In this case, the accounting equation for the rent received in advance is as below:

As in the example above, we can make the accounting equation for rent received in advance on December 28, 2020, as below: