What is Bank Confirmation Letter?

Bank Confirmation is the audit procedure perform by the external auditor to test cash balance at bank. Auditor simply sends a letter request for the client’s bank information such as balance, interest and so on. It is the most reliable audit documents as it is prepared by reputable third parties if compare to other documents provided by the client. Auditors receive bank confirmation directly from the bank, so it will increase the quality of documentation.

Auditor is very concerned about the bank balance if it is reflected with the bank reconciliation and the balance on the balance sheet. Bank confirmation also helps auditor to confirm the ownership of the bank account as well.

Important Note for Bank Confirmation:

- Prepare and Approved by client’s authorized person: Bank confirmation must be signed by the authorize person (client) in order to prove that the owner approved on such confidential information. Without proper approval from client, the client may not respond to the request as it contains the client’s information. The auditor can coordinate the template preparation but it must be review and approved by the client.

- Send by Auditor: Bank confirmation must send by auditor and return back to auditor. The reply documents must not go through client. The letter must state clearly about the return address which is the auditors’ office.

- Should not put the bank accounts number: Auditor sends confirmation to obtain all information regarding client bank account. Client may have multiple bank accounts under the same name. So confirmation must put only client name which is the message to the bank to send back all bank account under client name. If we specify the account, bank may send back only that number and ignore other balances.

- Additional Evidence: In addition to the testing of cash at bank, bank confirmation also uses as additional information for loan deposit and contingent liability.

Alternative Test to Bank Confirmation

Auditors may not receive a response from bank or it lose during the delivery. If the bank is overseas, there will be a high chance of no response or it may come late. The auditor may conduct alternative testing if they feel that the response is late or will not happen.

- Check Original Bank Statement: Client usually request bank statement from the bank to do bank reconciliation. So by the time we perform audit, the bank statement suppose to arrive at the client. We can ask client and have the statement check.

- Check Electronic Balance: Some banks have online access which allows the client to log in and view balance and transaction. Auditors may ask client to log into the bank website to view balance on the reporting date. While checking balance, auditor should carefully inspect bank website (URL) to prevent any fraud. If everything is correct, auditor should take a screenshot as evident. However, auditor must not accept a screenshot without a live inspection.

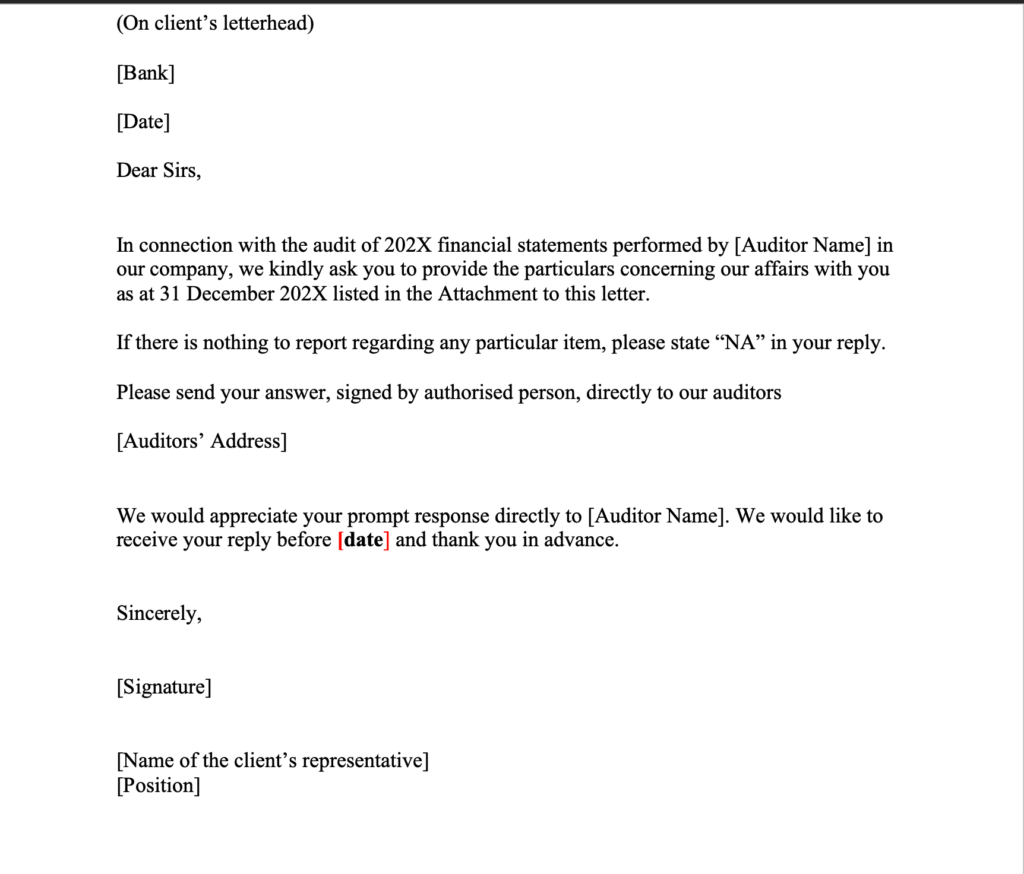

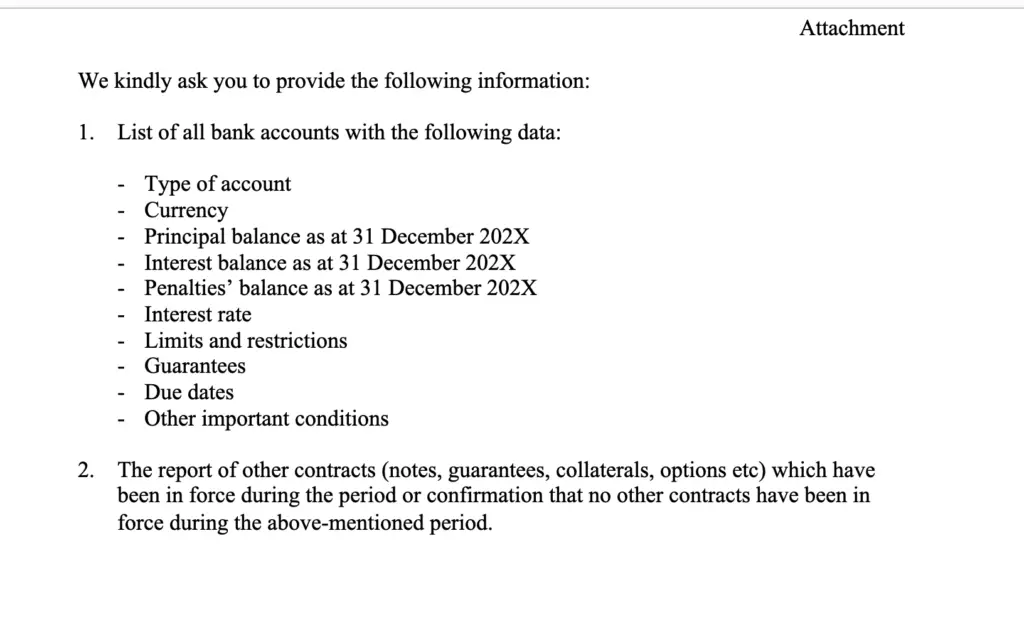

Bank Confirmation Template

This is the standard bank confirmation template use by auditor to seek relevant information from the bank.

Download the Bank confirmation template in link below: